Investing and wealth creation have been at the forefront of American thought for some time and have remained a topic of widespread discussion throughout. In recent years, the accessibility of the stock market and alternative assets such as cryptocurrencies and NFTs have inspired a new, younger class of potential investors. But while these investment vehicles may be flashier, they also come with a level of volatility that represents a significant risk for most portfolios. Real estate avoids the ebb and flow of popular culture and remains one of the most concrete ways to establish a long-term, wealth-building portfolio.

And while getting started may not be as easy as clicking 'buy' on your RobinHood app, it's not nearly as convoluted as it may seem to a new investor. This blog will lay out the different types of common real estate investments and take a superficial look at how you can start your real estate investing journey.

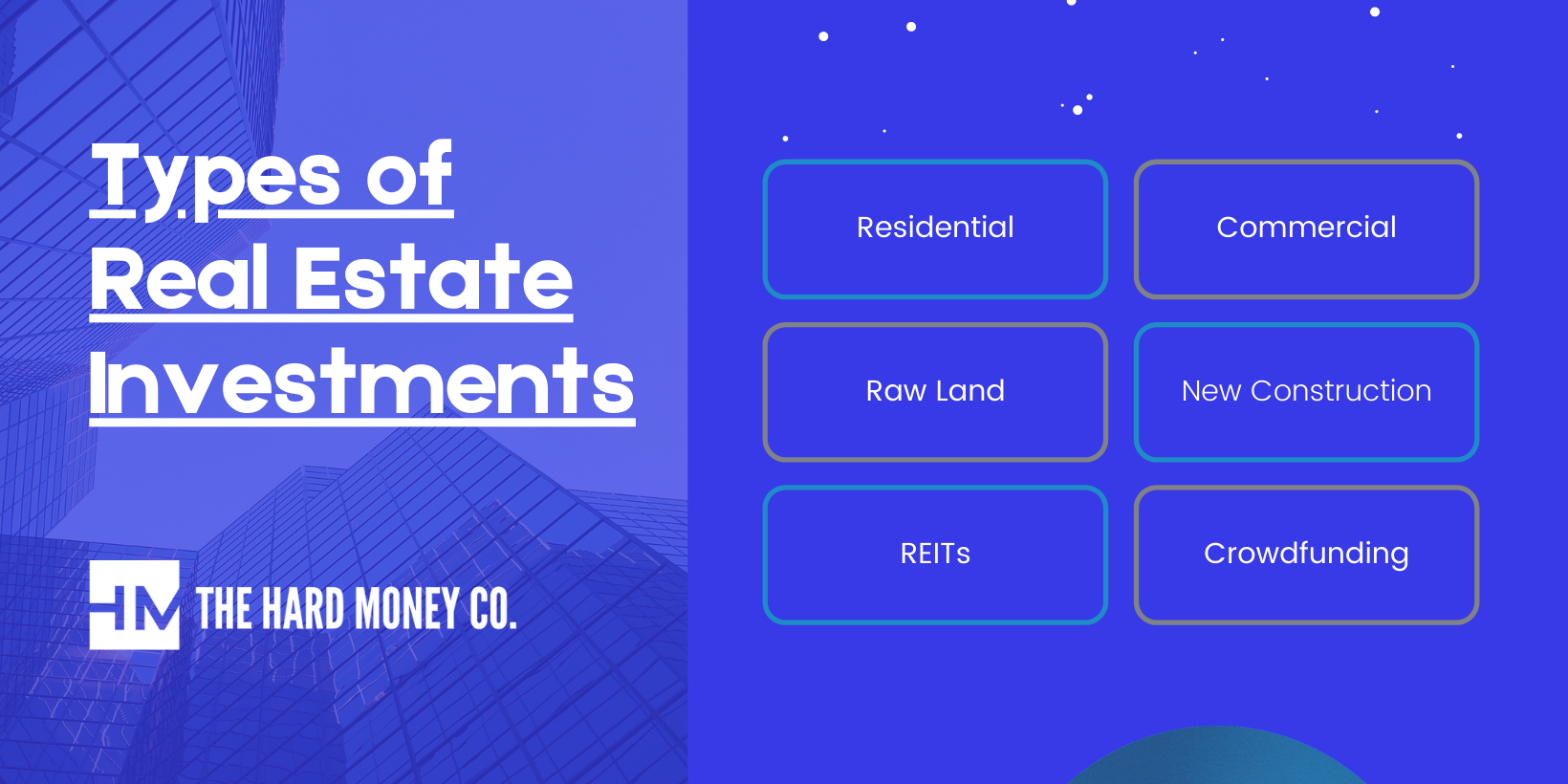

Main Types of Real Estate Investments

We wouldn't claim that these are all of the types of real estate investments, but these are the primary ones that you should know and investigate if you're looking to start investing. Most people are generally aware of each of these categories, but may not have considered the degree to which they can be accessed by first-timers. Each of these different investment vehicles comes with pros and cons that may determine your ability to generate a wealth-building return on your efforts.

- Residential Real Estate

- Commercial Real Estate

- Raw Land & New Construction

- Real Estate Investment Trusts (REITS)

- Crowdfunding Platforms

Residential Real Estate

Residential properties are a great way to get your foot in the door of real estate investing. There are a number of different types including duplexes, multifamily homes, and vacation properties, but the most common is a single-family home. One of the reasons it's so accessible is that these assets are readily available in most communities and often come at the lowest price point. Most importantly, they can quickly turn into a cash-flow generating property with a little bit of upfront capital and legwork.

There are a number of different strategies that can be deployed to meet your goals (BRRRR, Fix & Flip, Wholesaling, Buy & Hold), and choosing the right option for your path is essential. Consider the strategy that suits your need and market before beginning. A well-executed investment strategy in the residential real estate space can yield significant profits and steady cash flow while acting as the backbone of a growing portfolio.

Commercial Real Estate

The list of commercial properties is even longer than that of residential and can include industrial, office, retail, distribution, hospitality, and many more. The barrier to entry in the commercial world may be a little steeper than alternative property types, but the impact can be far more significant as well. With commercial tenants, the cash flow on any unit may be dramatically higher than with renters. Additionally, commercial tenants typically seek longer rental periods and in many cases pay the monthly costs such as utilities, maintenance, or taxes. All of these combine to give you, the investor, more profit potential on your asset.

Commercial real estate also has the added benefit of being less competitive than many residential investment opportunities, because these types of properties require more capital and effort. Once you're established, however, you can really see a dramatic effect on your real estate portfolio.

Raw Land Investing and New Construction

Though these are technically two different types of real estate investments, they do represent one unique way to diversify a real estate portfolio. Raw land is a vacant property that has future potential for development. This is a more attractive opportunity in markets that may have high levels of projected growth. This is not a quick turnaround endeavor and investors may be holding these assets for some time. That said, the recurring costs associated with the property are minimal and may return high levels of profit if you've correctly anticipated the market.

New construction is very similar, with the key differentiator being that the tangible assets on the underlying land are already being developed. Investing in the construction itself allows you to determine the best use for the property and fit the building to the future plans. Additionally, investors may have the opportunity to partner with builders or other contractors to minimize their upfront investment. While the partner will like to realize back-end ROI, it may be mutually beneficial to all involved.

Though the upside is potentially large, the risk is also increased in new construction. If you did not perform adequate market research, you may overinvest in a property that is limited by outside factors. But with strong analysis and the right property, raw land and new construction can be exceptionally strong assets.

Real Estate Investment Trusts (REITS)

Real estate investment trusts, also known as REITS, are essentially a portfolio of individual properties managed by an individual company. They typically limit themselves to commercial properties, but that too has changed in recent years with the emergence of some residential players on the market. Investing in a REIT means allocating capital to the company that they, in turn, invest in ROI generating properties. You, as an investor, are completely removed from the research, acquisition, or management of any of the properties, while still generating ROI on your capital. This represents a great way to diversify your stock portfolio into real estate without the effort required to learn the industry yourself. REITs are regulated independently and are required to return 90% of income to shareholders in the form of dividends. REITs are also highly liquid as they are exchanged openly on most stock exchanges.

Crowdfunding Platforms

Crowdfunding is not dissimilar from REITs in that you are simply allocating capital to be managed by others. That said, you are investing directly in specific properties which increases the risk attached to your capital. Whereas transactions such as these were previously inaccessible to all but the ultra-wealthy, the advent of crowdfunding has dramatically reduced the initialization costs to attach yourself to high-potential real estate. Crowdfunding companies are also likely to be less liquid than REITs. Your capital may be tied up for some time based on terms dictated in your contract.

Conclusion

While these may not represent all of the real estate adjacent investment opportunities, these are the most prominent ones. This is especially true for beginners. Take the time to explore these different opportunities and determine which one best suits your capital amount, investment horizon, disposition, and capability. A comprehensive understanding of all of these real estate investment types will only aid you on your chosen path.