April 23rd, 2024

The Art of Property Valuation

The entire game of fix-and-flip or BRRRR real estate investing hinges on acquiring a distressed asset well below its potential value. You buy low, invest sweat equity, and then profit handsomely when you sell the property at market rates. Identifying properties with the largest delta between purchase price and After Repair Value (ARV) is crucial in determining whether a real estate investor will ultimately succeed. However, it’s not always easy.

Determining the potential After Repair Value of a property is perhaps the most overlooked aspect of real estate investing. The accuracy of your valuation can determine whether you’re poised to make $50,000 or just pouring money down the drain. At The Hard Money Co., we perform these valuations on hundreds of properties every month and have a well-defined process for determining accurate values. Let us share some of the strategies and tactics we’ve learned over the years.

Why Do a Property Valuation?

The primary reason to perform a valuation is to create a strategic framework for your investment property. An accurate After Repair Value (ARV) informs you how much you should pay for the property, how much to invest in renovations, what your financing strategy should be, and more. Most crucially, it predicts your potential profit from the investment. Misjudging a valuation can adversely affect each of these aspects.

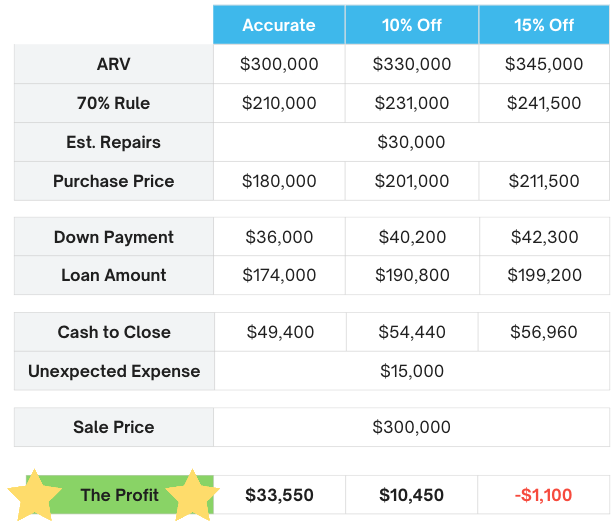

We encourage investors to employ the 70% rule in their budgeting strategies. This rule dictates that once you have established an ARV, you should deduct your estimated repair costs. You should then aim to pay at most 70% of the remaining figure to acquire the property. This approach provides a buffer for uncertainties such as financing costs, unforeseen repair issues, commission fees, contingency costs, and more. The simple graphic below illustrates how minor deviations in your ARV calculation can significantly impact these costs and erode your bottom line.

Investors should always seek more and better information. Accurate property valuations are the best way to achieve this.

Here are the primary steps of performing a property valuation that every investor should implement into their process:

- Location & Boundaries

- Define a radius around the property (adjust for urban vs. rural) and consider tangible boundaries.

- Unit Style & Type

- Comparables should have the same unit mix (Single-Family, Duplex) and same style (Condo, Ranch, Colonial).

- Core Metrics

- Evaluate essential metrics like year built, number of bedrooms and bathrooms, square footage, and lot size.

- Basement & Garage

- Consider whether they’re finished/unfinished, attached/detached, or even exist at all.

- Sale Date

- Focus on recent sales, generally within the last six months, but up to a year in areas with fewer transactions.

- Property Condition

- Otherwise identical homes can vary significantly in valuation based on maintenance and construction quality.

Location Matters

Location is paramount in the valuation process, yet many investors tend to be overly generous with their criteria. Comparable properties need to be exceptionally close to qualify as true comps. In urban settings, this typically means within tenths of a mile, but definitely no further than a half-mile radius. As you venture into suburban and rural areas, while you may have some leeway to expand this radius, proximity remains key.

Investors must also recognize the significant role that boundaries play in determining values. Highways, main thoroughfares, bodies of water, school district lines, and similar demarcations are critical. Crossing one of these boundaries—whether physical or administrative—can substantially affect property prices.

Whats in style?

Investors must ensure they are making like-for-like comparisons concerning unit style and type. It may sound straightforward, but a duplex is valued differently from a single-family home, even if both feature 4 bedrooms, 2 bathrooms, and measure 1,250 square feet. These are fundamentally different property types. The same logic applies to architectural style; for example, a ranch-style home typically carries a distinct value from that of a Cape Cod. Comparing disparate property types and styles is inadvisable, as their values are unlikely to align accurately.

Beds, Baths, and Beyond

Core metrics such as the number of bedrooms, bathrooms, and square footage are fundamental comparison points in property valuation. While critical, they shouldn’t overshadow other important factors. Matching core metrics is a starting point, but it doesn’t automatically qualify two properties as comparable.

When it comes to flexibility within these metrics, it’s a matter of scale and proportionality. A one-bedroom home cannot be equitably compared to a two-bedroom one due to the significant lifestyle and market differences these properties cater to. However, the difference between a four-bedroom and a five-bedroom home may be less impactful, considering the potential buyer or renter pool for larger homes can be more fluid. The key is understanding that as the number of bedrooms increases, the difference each additional room makes diminishes proportionally. Therefore, it becomes a question of whether the additional space aligns with market demand and valuation.

In addition to the interior square footage, we consider the property’s lot size, ensuring it falls within a 20% variance range. This level of variance allows for some diversity in property types while still maintaining comparable value brackets. A property with significantly more or less land can attract a different kind of buyer or investor, thus affecting its value in the marketplace. Hence, matching both the built space and the lot size within this threshold helps us home in on properties that share a more accurate potential value.

Bargain Basement

Basements and garages are essential features that must be taken into account to ensure properties are comparable. Firstly, confirm whether each property possesses these features, as their presence can vary greatly by region. With basements, the primary consideration is whether they are finished. A finished basement not only contributes additional square footage but can also significantly increase a property’s value compared to an unfinished space.

Similarly, with garages, it’s important to compare like with like. An attached garage may offer different utility and appeal compared to a detached one. Moreover, the capacity of the garage, whether it’s a single, double, or even larger, can impact the property’s desirability and worth. These characteristics must align closely when comparing properties to ensure an accurate assessment of their comparative market values.

The Hard Money Co.

Using hard money loans allows real estate investors to maximize leverage when purchasing a property and close within just a few days, all while freeing up their own cash for other uses.

Sell, Sell, Sell (Date)

Frequently, aspiring investors reference high-value sales from the peak of the housing market, hoping to justify a higher price for their current investment. However, these figures are not viable benchmarks for present-day property valuation. Our approach is to examine sales within a recent six-month period for the most relevant and current pricing information. In cases where comparables are scarce, we may extend our review to a year, but this is not the norm. Especially in urban areas, there should be ample data from just the past few months to establish a reliable valuation. It’s important to stay current to ensure an accurate and defendable property valuation.

Conditioning

Property condition is an area where we often observe individuals taking liberties in their assessments. It’s crucial to acknowledge that even when all other criteria align, a newly renovated home is not comparable to one that hasn’t been updated since 1979. While you may not need to extrapolate price differences based on quality and condition minutely, such properties should not serve as comps for one another. It’s imperative to source comparables that are similarly maintained for your valuation. Although this evaluation can be subjective, honesty is key; available online images usually provide a clear enough indication to prevent self-deception regarding a property’s condition.

Recent Blog Posts

Connect with The Hard Money Co.

Sign up for our mailing list and receive educational material, insights into your market, and exciting offerings from our partners.